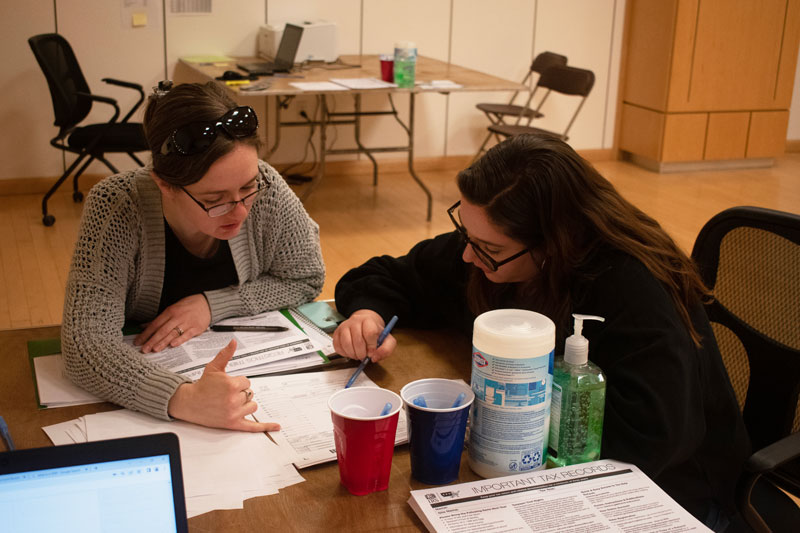

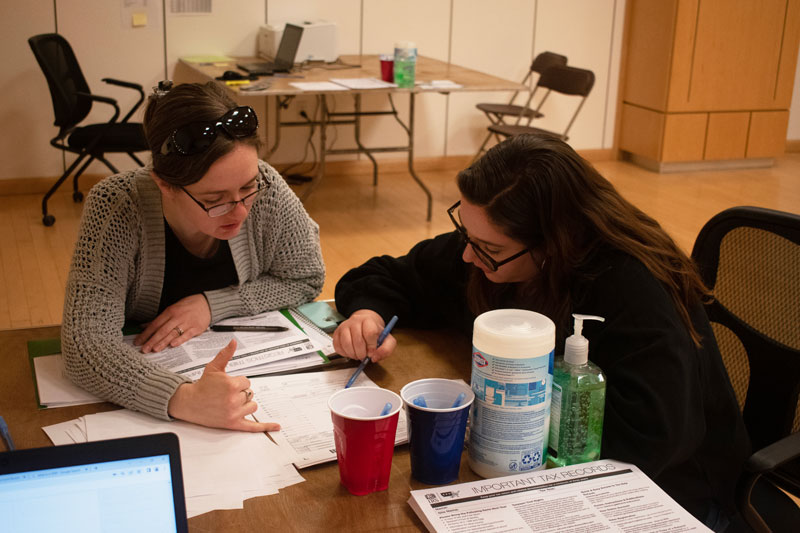

Tax season is in full swing, and Champlain College students in the Stiller School of Business are working to help as many Vermonters as possible prepare their taxes.

Students majoring in Accounting are leading the project, as they have for the past 40 years, through the Volunteer Income Tax Assistance Program (VITA).

This national program aims to provide tax assistance to those making under $60,000 a year, elderly residents, and people with disabilities. Any Vermonter can reach out through 211 to schedule an appointment if they meet the eligibility criteria. Walk-ins are also accepted at the University Mall.

In addition to gaining valuable experience in the tax and accounting fields, Champlain students engaged in the VITA Program can say they’ve helped make a positive economic impact in the local community. “Last year, we completed 1,400 tax returns and awarded approximately $2.7 million in eligible refunds,” Accounting Professor Nicole Morris told WCAX. “So it impacts a multitude of Vermonters.”

Accounting major Martina Monroe ’23 is one of several students receiving credit in exchange for this experience. She was interviewed by MyNBC5 about the volunteer program.

“Just being able to take that one weight off of their shoulders and help them with their taxes and then they can walk out without having to worry about that stressor is really quite rewarding,” Monroe told MyNBC5.

Students like Monroe gain a minimum of 40 hours of hands-on experience plus valuable career-preparation and customer engagement skills. The program relies on Champlain students, who typically make up 75% of the program’s volunteers.

“Being a VITA volunteer through Champlain College has allowed me to gain real-world career experience that will give me a step up after graduation, and help members of my community that need assistance. It’s been extremely rewarding and has reinforced my decision to pursue this field of work full-time,” adds Monroe in this Inside Higher Ed piece.

In order to qualify to participate, Champlain College students engage in a three-day workshop on tax law and preparation run in conjunction with the IRS, culminating in a test and IRS-certification.

“Champlain Valley Office of Economic Opportunity really relies on Champlain College students to serve as volunteers for income tax assistance and preparation and over the years, we’ve had hundreds of students that have participated in the program,” Morris added in this Accounting Today feature.

Visit our website to learn more about our Accounting program.