A poll conducted on behalf of the Center for Financial Literacy at Champlain College recently reported that there is overwhelming citizen support for implementing personal finance education in high schools across Vermont.

More than nine out of 10 Vermont residents believe that personal finance education is an important subject that should be taught in high school. This overwhelming finding emerged from a statewide poll of 541 voters conducted this month by Public Policy Polling for the Center for Financial Literacy at Champlain College.

John Pelletier, Director of the Center for Financial Literacy, notes that the poll shows:

- 93% of Vermont residents agree that a personal finance course should be offered in high school

- 88% of Vermont adults believe that guaranteed access to a personal finance course for all Vermont high school students is urgently needed

Yet, despite these views, currently, few Vermont high school students have guaranteed access in high school to a full-semester course in personal finance prior to graduation.

Pelletier believes this poll data will help state education policy makers, legislators, the State Board of Education, and the Agency of Education make informed decisions regarding personal finance education in Vermont’s public schools.

“Personal finance education changes behaviors in positive ways,” says Pelletier. “Research demonstrates that high school students with this knowledge improve their own money management practices, and share this learning with their families, resulting in improved parent knowledge, saving, and spending behaviors.”

He also notes that individual financial literacy means healthier family balance sheets, which in turn builds a stronger state economy. Studies like this one show employees who are money savvy are happier with and remain longer in their jobs.

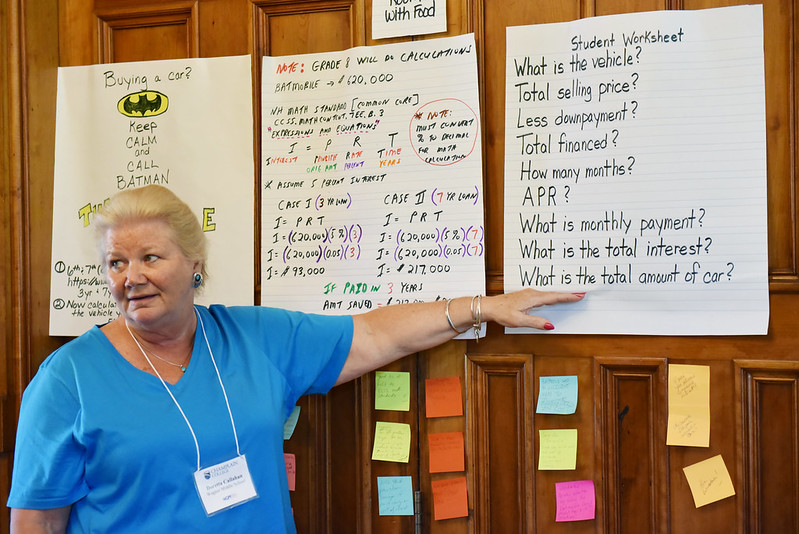

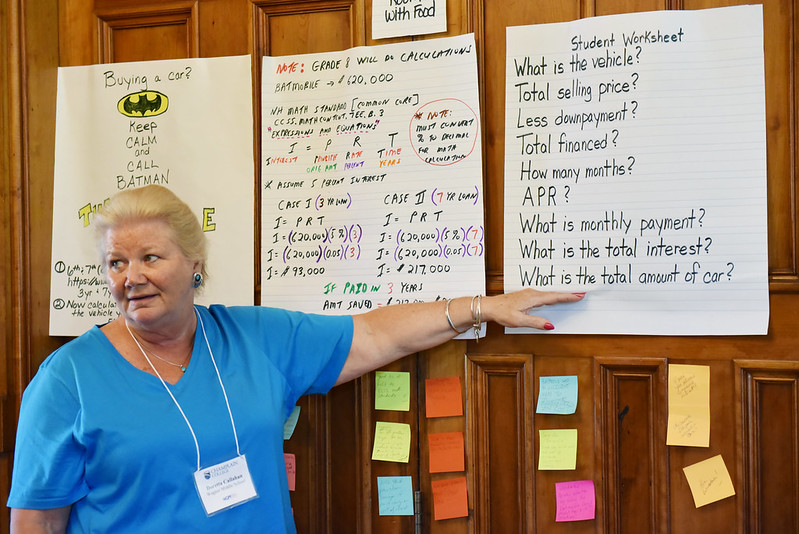

Courtney Poquette, who teaches personal finance at Winooski High School, says she and her students believe it is the most important high school course in 2023. “It’s the one course Vermont students will take in high school that they will use every day for the rest of their lives.” Her former student David Klinker, now a student at Champlain College, agrees, and wrote a commentary piece in VT Digger outlining how the course completely changed his life.

Pelletier says there is a national movement to bring the subject to more high schools, since just 1 in 4 students nationwide currently have access to a guaranteed course.

Personal finance is also an issue of equity, says Pelletier. He points to this 2022 study by Next Gen Personal Finance, which shows that in states that do not guarantee access to personal finance education those who arguably need this training the most are the least likely to receive it. In these states, which includes Vermont, wealthy and less diverse high schools are approximately three times more likely to guaranteed access to this training than very poor and very diverse high schools in our nation.

On the positive side, he notes that last year, six more states passed legislation guaranteeing a personal finance course, bringing the total number of states with such guarantees to 17. He also notes that it is expected that a dozen more states will consider this change in 2023, Vermont being among them.

In the state poll:

- 87% of respondents indicated that high school personal finance education was very important and 12% said it was somewhat important

- 93% of respondents said a course covering budgeting, investing, taxes and saving should be offered in high school

- 83% felt the course should be guaranteed for all students

Informed that just 12 percent of high school students in Vermont were guaranteed a personal finance course, 88 percent of poll respondents said a law requiring such a course is an urgent issue. Currently in Vermont, only Black River, Lamoille, Milton, Missisquoi, Spaulding, Vergennes and Winooski high schools provide students with guaranteed access to personal finance in high school. BFA St. Albans plans on joining this list.

A bill calling for a course in civics was introduced in the last session of the Vermont legislature, so the poll also included questions on this issue.

- 84% of respondents believe a course in civics— covering the Constitution and matters related to the U.S. government—is very important

- 92% indicated that such a course should be taught

- 85% of respondents believe civics should be a guaranteed course

Pelletier notes that personal finance education doesn’t stop in high school. A 2019 U.S. Treasury Department report on financial literacy best practices for colleges included the recommendation that colleges “should require mandatory courses to teach students financial concepts and skills.”

Champlain College is one of the few colleges that requires its on-campus undergraduate students to take personal finance training as a graduation requirement. Our InSight Program teaches students fundamental personal finance skills including how to negotiate your salary (including benefits and evaluation of compensation packages), create and follow a budget, establish credit, manage debt, invest your money, and more.

“Champlain equips its students with the life skills needed to complement academic and career success,” said Olivia Vittitow, InSight Program Manager. “Embedding four years of financial, personal, and wellbeing-focused workshops, seminars, and one-on-one coaching as a part of our undergraduate requirements has resulted in Champlain graduates avoiding student loan default issues and enjoying financial stability after graduation.”

Visit the Center for Financial Literacy’s webpage to download the full poll results and click here to watch Pelletier discuss the findings on WCAX.